About Us

Who We Are

With approximately $5.2 billion in assets under management, and an over 10-year heritage as a global owner and operator, we focus on investing in the backbone of the global economy, and are committed to supporting and enhancing the communities in which we operate.

We put our own capital to work alongside our partners’ in virtually every transaction, aligning interests and bringing the strengths of our operational expertise, global reach and large-scale capital to bear on everything we do.

investment professionals

investments globally

Leveraging Our Operating Expertise

Our experience as owners and operators enables us to effectively enhance cash flows, increase the value of our investments and produce solid long-term returns for our investors.

On-the-Ground Insights

Well-resourced operations in strategic locations around the world provide real-time market intelligence and bottom-up investment insights.

Hands-On Operations

Our integrated teams of seasoned operational professionals take an active role in maximizing the performance of our assets and businesses.

Comfort with Complexity

Across market cycles, we have built an expertise in executing large, creative transactions and managing ongoing growth projects to drive value.

Investing on a Value Basis

We seek to deliver attractive long-term returns and provide strong downside protection for our investors—including pension plans, endowments, foundations, sovereign wealth funds, financial institutions, insurance companies and the private wealth channel.

Contrarian View

We recognize that generating attractive returns often requires seeking out assets, businesses, markets and sectors that are out of favor or experiencing periods of distress.

Focus on Quality

We are disciplined in acquiring high-quality assets and businesses that we believe can provide strong downside protection across market cycles.

Patient Approach

We take a long-term view in deploying capital but are ready to act decisively when the right opportunities emerge.

Sustainability at Our Core

We are more than simply an investor—we are active participants in industries and economies around the world, and committed to the long-term health of these local markets.

“Sustainability is in the fabric of our

DNA. It is fundamental to our business

and how we create value.”

OUR STRATEGIC PILLARS

A set of fundamental shifts in 2020 profoundly impacted the financial services sector. The demand for sustainable solutions and green finance rose to new highs. Interest rates are expected to remain lower for longer. And the Covid-19 outbreak increased our customers’ propensity and preference to engage digitally.

The current stage of our strategic plan responds to those shifts and aligns to our new purpose, values and ambition. It has four key pillars.

Focus on our strengths

To achieve our ambition, we are focusing on the areas where we have distinctive capabilities. This pillar of our strategy outlines where we are prioritising our efforts and investing for the future. We aim to:

- Be the global leader in cross-border banking flows aligned to major trade and capital corridors

- Lead the world in serving mid market corporates globally

- Become a market leader in Wealth management, with a particular focus on U.S.A, Europe and Asia

- Invest at scale domestically where HSBC’s opportunity is greatest

Energise for growth

This pillar of our strategy outlines how we are energising around growth. We want to:

- Inspire a dynamic culture where the best want to work

- Encourage an inclusive culture fostering diversity

- Help colleagues develop future-ready skills

- Be a simpler, more agile and effective organisation

Digitise at scale

As people lead increasingly digital lives, this pillar of our strategy outlines how we are delivering faster, easier and more secure digital banking . We will:

- Create and deliver fast, easy, digital customer experiences

- Partner with technology innovators to enable new customer benefits

- Ensure our company is resilient and secure

- Execute with speed and automate at scale

Transition to net zero

We want to do more than simply play our part in the transition to a more sustainable world. This pillar of our strategy outlines how we will help to lead it. We have committed to:

- Become a net-zero company

- Support our customers to transition to a low carbon future, especially in carbon challenged industries

- Accelerate new climate solutions

- Inspire our customers to invest to support positive change

Our Purpose and Values

Our Values Client Service

Excellence

Integrity

Partnership

OUR EXPERTISECreate a brighter Future together

Developing Best Financing Options

Improving Your Business Planning

Financial Modeling and Analytics

Delivering New Financing Solutions

01Leading Companies

Scale industry players that are growing market share

02Attractive Industries

Secular tailwinds with long-term demand

03Experienced Management

Partnership with proven managers who make personally meaningful equity investments with us

BUSINESS METHODOLOGYOutside the box solutions

HTA Private Equity

Over the past 10 years, our global investment teams have developed a wide range of product solutions to address clients’ varied and evolving needs. From core and multi-sector investing to more focused mandates.

We offer innovative and differentiated techniques expressly designed to support our clients as they navigate each unique economic cycle. The capabilities of these teams are available through individual strategies or combined in custom-blended solutions.

OUR EXPERTISEStrategy driven leadership development

Our goals are to maximize individual potential, increase commercial effectiveness, reinforce the firm’s culture, expand our people’s professional opportunities, and help them contribute positively to their greater communities.

Capitalizing on the real-world experience

BUSINESS GROWTHImprove performance and efficiency

A clear strategy developed by us, for all our stakeholders

Our strengths

A solid financial position

We are rated AA–/positive by Standard & Poor’s. Our solid financial position reassures our customers that we will be there when they need us to handle their claims and gives confidence to our shareholders that we are financially stable. It also gives us a well-earned positive reputation as a business and employer, and positions us to invest in future growth.

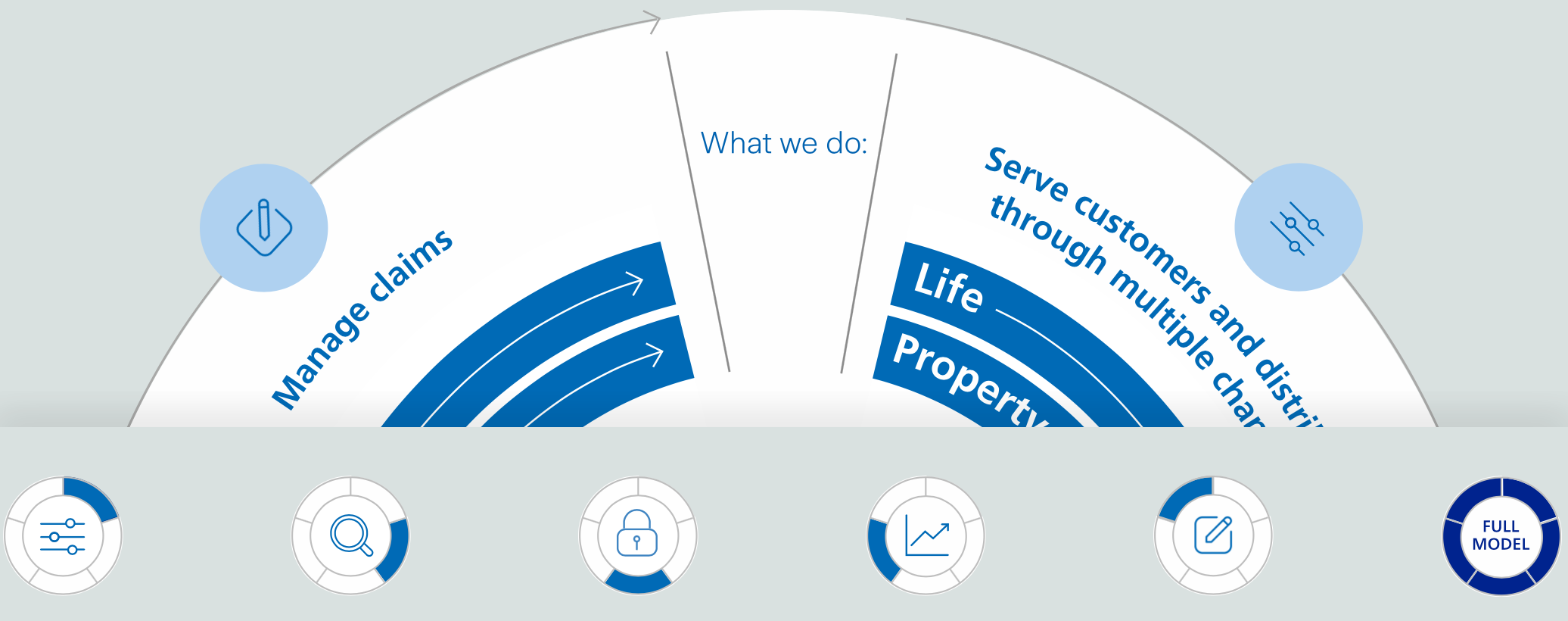

A balanced business

Our business is balanced both geographically and by products and customer segments. Our strong retail and commercial franchise and flexible operating model means we can weather economic and market volatility and take advantage of industry change.

A trusted brand, talented people

We understand the risks our customers face and can structure offerings that meet their needs. This reinforces our global brand, one of the most valuable in the insurance industry. Our strong reputation allows us to attract the best talent worldwide.

Our targets for 2020-2022

BOPAT ROE1

>14%

and increasing

Compound organic earnings per share growth2

at least

5%

per annum

Swiss Solvency Test ratio3

160%

or above

Net cash remittances

USD

>2 bn

(cumulative)

We see opportunities to grow the business. We will remain cost-driven and continue to simplify the organization. We aim to improve portfolio quality and make better use of capital.

1 Business operating profit after tax return on equity, excluding unrealized gains and losses.

2 Before capital deployment

3 From FY-20 the basis for the Group’s target capital has been changed to the Swiss Solvency Test (SST). Previously the target was based on the Group’s internal Z-ECM basis.

Our business model works to deliver benefits for our stakeholders

Our employees are helping our retail and commercial customers to understand and protect themselves from risk.